Replacement. Repair. Beautification.

State Farm’s Disappointing Service in Charlotte NC

Key Highlights

- State Farm’s service in Charlotte NC has been the subject of numerous complaints from homeowners.

- Common complaints include delays in claims processing, disputes over coverage, and inconsistent communication.

- Roof replacement has been a particularly contentious issue, with State Farm often only agreeing to cover partial repairs.

- State Farm’s response to claims has been criticized for its lengthy and complicated process.

- Homeowners have reported experiences of claim rejections and difficulties in dealing with State Farm’s customer service.

- Comparisons with other insurance providers reveal that State Farm’s policies and service fall short in terms of customer satisfaction and coverage options.

Introduction

State Farm, one of the largest insurance providers in the United States, has been facing criticism for its service in Charlotte, North Carolina. Homeowners in the area have shared their disappointing experiences with State Farm, citing issues with customer service, homeowners insurance, and insurance coverage. This blog aims to shed light on the challenges faced by homeowners in Charlotte when dealing with State Farm and analyze the company’s response to claims. Additionally, we will compare State Farm with other insurance providers to determine if there are better options available for homeowners in the area. Understanding the issues and exploring alternatives is crucial for homeowners in Charlotte who want reliable and satisfactory insurance coverage for their homes.

Understanding the Challenges with State Farm in Charlotte NC

Navigating the world of insurance can be complex, and homeowners in Charlotte have encountered their fair share of challenges when dealing with State Farm. From issues with customer service to disputes over coverage, State Farm has left many homeowners feeling frustrated and dissatisfied. The process of filing a claim with State Farm can be lengthy and confusing, with homeowners often facing difficulties in understanding their coverage limits and receiving timely responses from the company. These challenges have led homeowners to question the reliability and effectiveness of State Farm’s service in Charlotte.

Common complaints from Charlotte homeowners

Homeowners in Charlotte have voiced several common complaints about their experiences with State Farm. One of the main issues is a lack of customer satisfaction. Many homeowners report feeling frustrated by the lengthy and complicated claims process, often resulting in delays in receiving the compensation they are entitled to. Additionally, some homeowners have expressed dissatisfaction with State Farm’s claims history, citing instances of claims being denied or only partially covered. This lack of transparency and consistency in handling claims has left homeowners feeling unsupported and uncertain about their insurance coverage. Overall, the common complaints from Charlotte homeowners highlight a need for improved communication and efficiency in State Farm’s customer service and claims handling processes.

Why is roof replacement a contentious issue?

One of the most contentious issues homeowners in Charlotte face when dealing with State Farm is roof replacement. Many homeowners have reported difficulties in getting State Farm to approve full roof repairs, with the company often only agreeing to cover partial repairs. This can lead to significant out-of-pocket expenses for homeowners. State Farm’s decision to leave out certain sections of the roof from repair, citing lack of damage, has been a source of frustration for many homeowners. Roof replacement is crucial for maintaining the structural integrity of a home and preventing water damage. Homeowners expect their insurance coverage to provide adequate protection in such situations, but State Farm’s approach to roof replacement has raised concerns about the company’s commitment to fully supporting homeowners in Charlotte.

Analyzing State Farm’s Response to Claims

Analyzing State Farm’s Response to Claims

State Farm’s response to claims in Charlotte has faced criticism for its lengthy and complicated process. Filing a claim with State Farm can be a time-consuming and frustrating experience for homeowners. The company’s claims process often involves multiple adjusters, resulting in a lack of consistency and familiarity with each case. Homeowners have reported difficulties in understanding their coverage limits and receiving prompt responses from State Farm. These challenges have raised questions about the efficiency and effectiveness of State Farm’s claims handling process in providing timely and satisfactory resolutions for homeowners in Charlotte.

The process of filing a claim with State Farm

Filing a claim with State Farm can be a complex and lengthy process for homeowners in Charlotte. The first step is to gather all necessary documentation, including an inventory of damaged items and documentation of the incident that caused the damage. Homeowners must then contact State Farm to report the claim and provide the necessary information. State Farm will assign an adjuster to the claim, who will assess the damage and determine the coverage amount. The adjuster may request additional documentation or information during the process. Once the claim has been reviewed and approved, State Farm will issue a payment to the homeowner. However, homeowners have reported delays and difficulties in the claims process, including disputes over coverage and lengthy wait times for resolution.

Homeowners’ experiences with claim rejections

Some homeowners in Charlotte have shared their experiences of claim rejections from State Farm. These claim rejections often involve disputes over coverage and liability. Homeowners have reported feeling frustrated and unsupported when their claims are denied or only partially covered by State Farm. In some cases, homeowners have had to seek legal action to dispute the claim denial. These experiences highlight the importance of understanding the details of insurance coverage and the need for clear communication between homeowners and their insurance providers. Homeowners expect their insurance coverage to provide financial support in times of need, and claim rejections can leave them feeling vulnerable and financially burdened.

Comparing State Farm with Other Insurance Providers

To determine if State Farm’s service in Charlotte is truly disappointing, it is essential to compare the company with other insurance providers in the area. Factors to consider include annual premium rates, coverage options, and customer satisfaction. By examining how State Farm measures up against other insurance providers, homeowners in Charlotte can make more informed decisions about their insurance coverage. It is important to remember that each insurance provider has its strengths and weaknesses, and finding the best fit for individual needs requires careful consideration of personal circumstances and priorities.

How State Farm’s policies differ from competitors

State Farm’s policies differ from those of its competitors in several key ways. One notable difference is the company’s approach to coverage options. While State Farm offers comprehensive coverage for homeowners, some competitors may offer more specialized coverage options, such as separate policies for specific perils or additional coverage for high-value belongings. Additionally, the annual premium rates for State Farm may vary compared to other insurance providers, as different factors are taken into account when calculating premiums. It is important for homeowners in Charlotte to carefully review and compare the coverage options, features, and pricing of different insurance providers to find the policy that best suits their needs and provides the desired level of protection.

Insurance options that offer better service in Charlotte

For homeowners in Charlotte who have been disappointed with State Farm’s service, there are alternative insurance options that may offer better customer satisfaction and coverage. Researching and exploring other insurance providers can help homeowners find companies that prioritize customer service and offer comprehensive coverage options. Looking for insurance providers with high customer satisfaction ratings, positive reviews, and a strong reputation for handling claims efficiently and fairly can be a good starting point. Consulting resources such as the Better Business Bureau and consumer review websites can provide valuable insights into the experiences of other homeowners in Charlotte with different insurance providers. By considering alternatives to State Farm, homeowners can find insurance options that better meet their needs and expectations.

Legal and Consumer Rights for Home Insurance Claims

Understanding legal and consumer rights is crucial for homeowners in Charlotte when dealing with home insurance claims. Knowing your rights as a policyholder can help ensure that you receive fair treatment and proper compensation from your insurance provider. Familiarize yourself with the fine print of your homeowners insurance policy, including coverage limits and exclusions. If your claim is denied or you are unsatisfied with your insurance provider’s response, you may have options for legal action or dispute resolution. Seeking advice from legal professionals or consumer rights organizations can provide guidance on navigating the claims process and protecting your rights as a homeowner.

Understanding your policy’s fine print

Understanding the fine print of your homeowners insurance policy is essential to ensure that you have the coverage you need and avoid any surprises when filing a claim. Take the time to carefully review your policy and familiarize yourself with the coverage limits, exclusions, and deductible amounts. Pay attention to specific details such as whether your policy covers replacement cost or actual cash value, as this can impact the amount you are reimbursed for a claim. Additionally, be aware of any additional coverage options or endorsements that may be available to enhance your policy’s protection. By understanding the fine print of your policy, you can make informed decisions about your insurance coverage and ensure that you have the appropriate level of protection for your home.

Steps to take if your claim is denied

If your claim is denied by State Farm or any other insurance provider, there are steps you can take to address the situation. First, review your policy and the reason provided for the denial to ensure that it aligns with the terms and conditions outlined in your contract. If you believe that the denial is unjust or incorrect, gather any supporting documentation or evidence to challenge the decision. Contact State Farm’s customer service or claims department to discuss the denial and provide any additional information or documentation that may support your claim. If these efforts are unsuccessful, consider seeking legal advice to explore your options for dispute resolution or filing a complaint with the appropriate regulatory authorities. Taking proactive steps and advocating for your rights as a policyholder can increase the chances of a favorable outcome.

Cutting comers to payout less to homeowners

Cutting comers to payout less to homeowners

State Farm has been known to cut corners to minimize payouts to homeowners in Charlotte. One common tactic is to push for repairs instead of full replacements, potentially saving the company money. Roof replacements, a common issue in Charlotte, are often contentious as State Farm may approve a replacement only to reverse the decision upon reinspection. Additionally, State Farm has faced criticism for categorizing hail damage as mechanical, leaving homeowners stuck with repair costs. These practices can significantly impact the coverage options offered to policyholders, potentially leading to disputes over coverage limits. When dealing with State Farm, homeowners must be vigilant about their entitlements under the policy, ensuring they receive fair compensation for valid claims, especially in cases of water or wind damage.

Repairing roof VS replacing roofs

When it comes to roof damage, homeowners often face the decision between repairing their roof or replacing it entirely. Insurance companies, including State Farm, may have different approaches to this issue. Some insurance companies may only agree to cover partial repairs, leaving homeowners responsible for the cost of replacing the undamaged portion of the roof. This can result in significant out-of-pocket expenses for homeowners. Additionally, insurance companies may have specific criteria for what constitutes sufficient damage to warrant a full roof replacement, which can vary from company to company. Understanding the coverage options and criteria of insurance companies when it comes to roof damage is crucial for homeowners in Charlotte who want to ensure they have adequate insurance coverage for their homes.

Approving roofs just to over turn the decisions

Horror stories in Charlotte in State farms practices

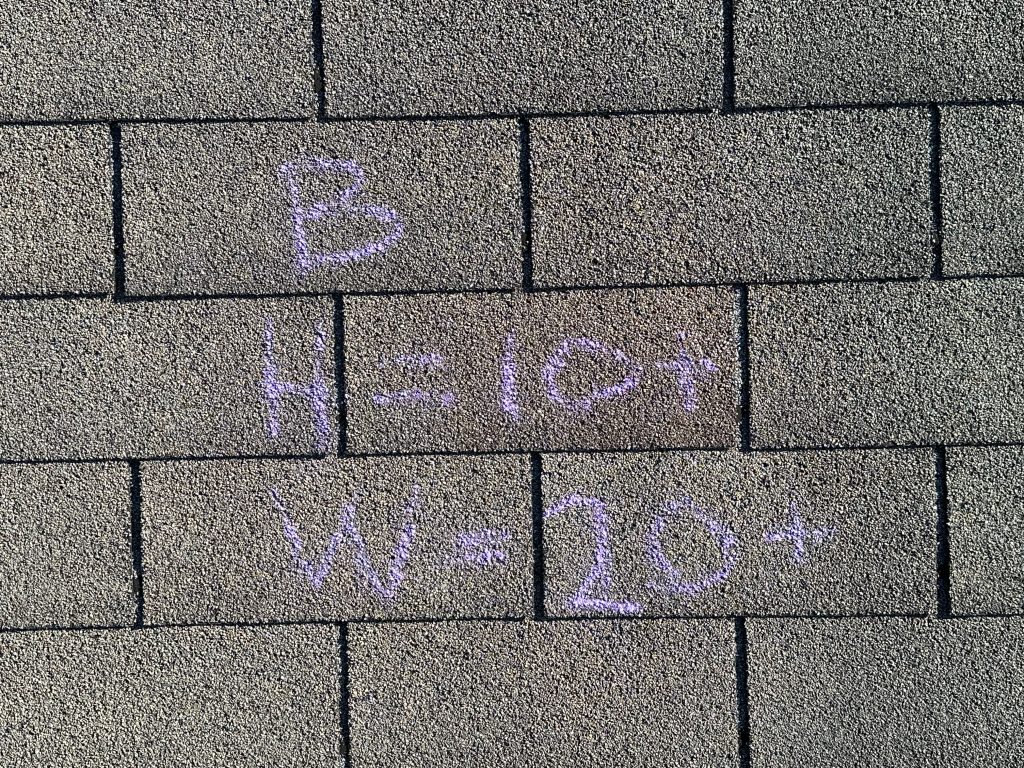

Homeowners in Charlotte have shared their horror stories regarding State Farm’s practices. One common theme is State Farm’s approval of roof repairs, only to later schedule an inspection to overturn the approval. This leaves homeowners in a state of uncertainty and financial burden, as they were initially led to believe their repairs would be covered. Additionally, homeowners have reported that all hail markers are considered to be mechanical damage by State Farm, resulting in denied claims for hail damage. These horror stories highlight the frustrations and challenges faced by homeowners in Charlotte when dealing with State Farm’s practices.

State farm will approve a roof, and then reschedule an inspection to over turn the approval

State Farm’s questionable tactics are evident when they seemingly approve a roof claim, only to later reschedule an inspection to overturn their initial approval. This misleading behavior creates a sense of distrust and inconsistency in their claim resolution process. Homeowners in Charlotte, NC, have faced the frustration of having legitimate claims initially accepted, only to be subsequently denied upon further review. This strategic move by State Farm raises concerns about their commitment to fulfilling their obligations promptly and fairly. Such actions not only delay the resolution of claims but also erode the confidence of policyholders in the insurer’s integrity. This practice highlights the importance of vigilance when dealing with insurance companies and emphasizes the need for transparency and fairness in claims handling processes. State Farm’s actions raise serious questions about their ethical standards and commitment to serving their policyholders diligently.

All hail markers are considered to be mechanical damage

All hail markers are considered to be mechanical damage

State Farm in Charlotte, NC considers all hail markers as mechanical damage, a contentious issue for homeowners. This categorization influences roof replacement claims and insurance coverage limits. In North Carolina, hail damage is often disputed due to its classification, affecting homeowners’ claims history and annual premiums. Understanding this stance is crucial when dealing with State Farm’s claims process for property damage. Despite the common belief that hail-related damages are weather-related, State Farm’s policy differs by deeming them mechanical. Homeowners in coastal areas like Charlotte need to be aware of these distinctions to navigate their insurance coverage effectively. In the event of hail damage, knowing how State Farm interprets the situation can impact financial decisions and the extent of coverage options available.

What should you do if you have statefarm

If you have State Farm and are dissatisfied with their service in Charlotte, it’s essential to take proactive steps. Firstly, review your policy in detail to understand your coverage limits and any specific exclusions that may apply to your situation. Be prepared to contest any unfair claim rejections based on the fine print of your policy. Consider seeking legal advice if necessary to ensure your rights are upheld. Additionally, explore alternative insurance providers in Charlotte that prioritize customer satisfaction and fair claims processing. Ending your association with State Farm can lead to a smoother claims process and better service overall. By making informed decisions and advocating for your rights as a homeowner, you can secure the coverage and support you deserve.

Stop investing in their commercials and find an alternative insurance company.

Find an alternative insurance provider quickly to avoid further disappointment with State Farm. Their commercial may seem appealing, but the reality of their service falls short. Look for insurance companies known for customer satisfaction and fair claims processes. State Farm’s practices may not align with your expectations, so why settle for subpar service? Take charge of your insurance decisions and switch to a provider that values your needs. Don’t waste time on a company that fails to meet your standards. Protect your home and investments by choosing an insurance company that provides peace of mind and reliable coverage. Don’t hesitate to make a change for a better insurance experience. Act now and secure a policy with a reputable provider in Charlotte, NC.

Best homeowner insurance companies in Charlotte 2024!

When it comes to finding the best homeowners insurance companies in Charlotte, 2024 has several options to consider. The table below provides an overview of some of the top insurance companies in the area, highlighting their coverage options, annual premiums, and customer satisfaction ratings.

|

Insurance Company |

Coverage Options |

Annual Premium |

Customer Satisfaction |

|

Comprehensive coverage, various add-on options |

Varies |

1 out of 5 stars |

|

|

Allstate |

Bundling, home upgrades, recent homebuyer discounts |

Varies |

1 out of 5 stars |

|

Smart home system discounts, various add-on options |

Varies |

3 out of 5 stars |

|

|

American Family |

Bundling, new and renovated home discounts |

Varies |

4 out of 5 stars |

|

Liberty Mutual |

Online purchase discounts, customizable policies |

Varies |

4 out of 5 stars |

|

Home security system discounts, various add-on options |

Varies |

3 out of 5 stars |

These are just a few examples of the top homeowner insurance companies in Charlotte in 2024. It is important for homeowners to thoroughly research and compare different insurance providers to find the one that best fits their needs and provides the desired level of coverage and customer satisfaction.

Conclusion

In conclusion, it is evident that the challenges faced with State Farm’s services in Charlotte, NC have raised concerns among homeowners. Understanding the nuances of filing claims, the contentious issues with roof replacements, and comparing State Farm with other insurance providers can help navigate through potential hurdles. Knowing your legal and consumer rights when dealing with home insurance claims is crucial. Consider exploring alternative insurance options that prioritize better service in Charlotte. By being informed and proactive, homeowners can make well-informed decisions and protect their assets effectively.

Frequently Asked Questions

Why are my State Farm claims being denied?

There can be several reasons why your State Farm claims may be denied. These can include issues with your claims history, insufficient insurance coverage, policy details that do not meet the requirements for a claim, and customer service issues. It’s important to review your policy and work with your State Farm representative to understand the specific reasons for the denial.

What are my options if I’m unsatisfied with State Farm’s service?

If you’re unsatisfied with State Farm’s service, you have several options. You can explore insurance alternatives and compare quotes from other insurance companies to find one that better meets your needs. You can also file a complaint with the Better Business Bureau or the appropriate regulatory agency. Additionally, you can work with State Farm to review your coverage options and address any concerns you may have.